Bill Gates is a pretty respected figure in EA circles. His commitment to helping people living in extreme poverty and to using evidence to inform his Foundation's work preceded EA but seems very well-aligned with EA's belief and efforts in global health and poverty reduction. I believe that the Gates Foundation has saved millions of lives.

This made it all the more surprising to hear that the Gates Foundation urged Oxford to abandon its plans to donate the rights to their COVID vaccine to a pharma company. The idea was to provide the vaccine at a low cost or free of charge. From Kaiser Health News:

"A few weeks later, Oxford—urged on by the Bill & Melinda Gates Foundation—reversed course. It signed an exclusive vaccine deal with AstraZeneca that gave the pharmaceutical giant sole rights and no guarantee of low prices—with the less-publicized potential for Oxford to eventually make millions from the deal and win plenty of prestige."

This struck me as a catastrophic move, turning a vaccine developed by a nonprofit institution into a way to make a company lots of money, with no clear upside. (I think if Oxford stuck to their original plan, they could control the IP and require that their manufacturing partner sell the vaccines at cost).

The article quotes James Love, director of Knowledge Ecology International, a nonprofit that works to expand access to medical technology:

"'[Bill] Gates has staked out this outsized role in the vaccine world,' Love said. 'He has an ideological belief that the intellectual property system is a wonderful mechanism that is necessary for innovation and prosperity.'"

A long-form article in the New Republic goes into much greater detail on what motivates Gates and the role he plays in global health. It describes how there was initial movement towards open collaboration on COVID research and efforts to ensure that knowledge was shared. Gates argued that IP restrictions like patents and trade secrets, wouldn't impede efforts to develop and distribute vaccines. His status as a global health heavyweight helped ensure that the response to COVID would respect existing international commitments to IP.

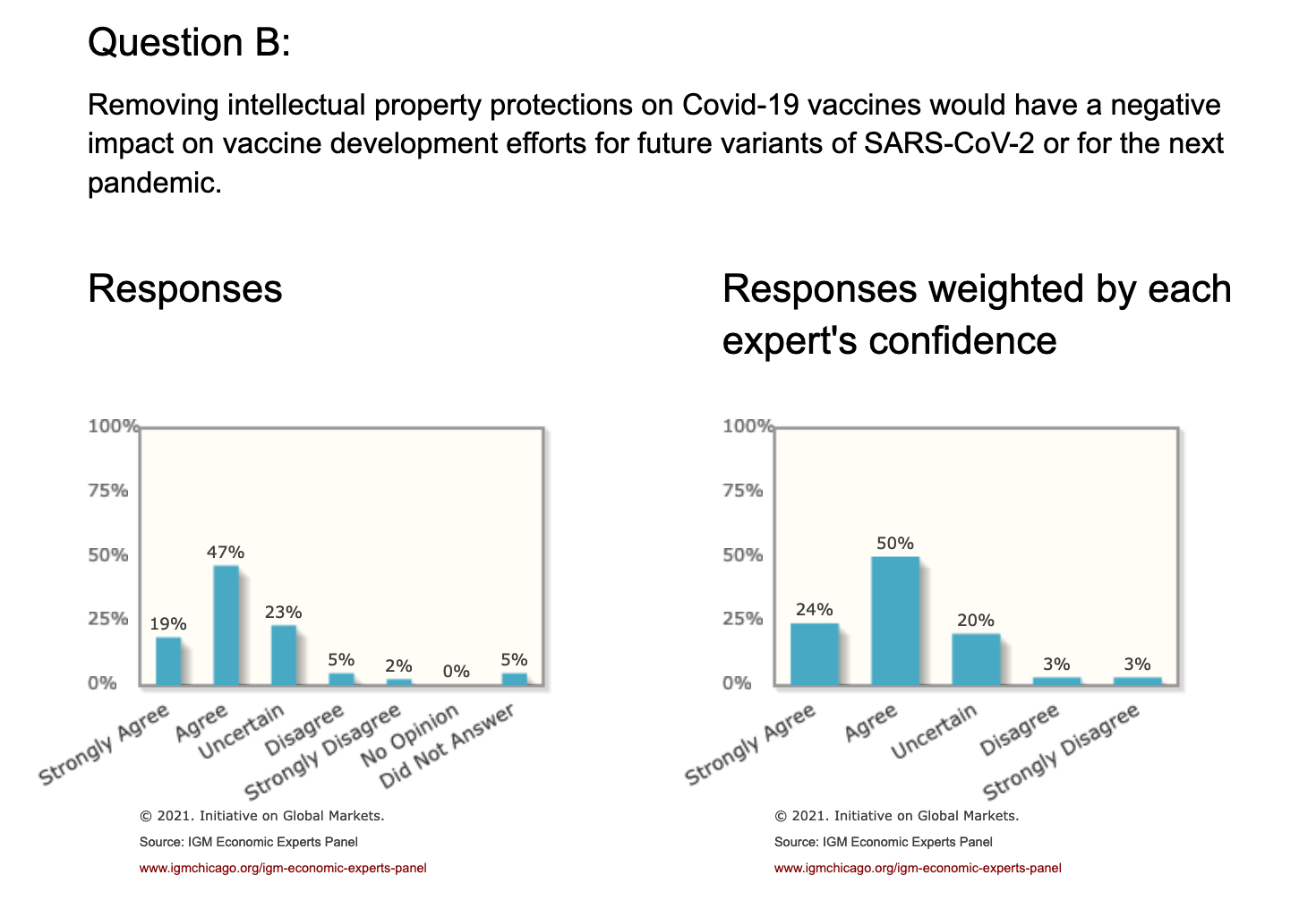

The article argues (persuasively in my opinion) that the global IP paradigm significantly impedes vaccine production. Companies that own rights to vaccines developed with enormous public investment and massive guaranteed government contracts are fighting any efforts to share the knowledge that could be used make more vaccines in more parts of the world.

Some objections are raised that there aren't many places that can manufacture vaccines that aren't already doing it (which strikes me as extremely unlikely, quite recently, J&J was forced by the US govt to let Merck help it manufacture its vaccine). With some projecting that poor countries won't be fully vaccinated until 2024, even if it takes a 1+ years to retrofit a plan to make the vaccine, it would be worth doing so.

The argument for companies being allowed legally enshrined monopoly rights to produce and sell vaccines is that developing a new drug is extremely expensive and risky, and companies won't do it if a competitor can copy their formula and undercut their sales. But in the cases of COVID vaccines, much of the cost of researching the drugs was publicly funded and risks were eliminated through government purchase guarantees. From a NYT Op-Ed:

"In fact, the novel technology at the heart of the Moderna vaccine, for example, was developed partly by the National Institutes of Health using U.S. federal funds. Moderna then received a total of some $2.5 billion in taxpayer money for research support and as preorders for vaccines; by the company’s own admission, the $1 billion contribution it received for research covered 100 percent of those costs."

In theory, companies use their profits to invest in further research, creating a dynamic and innovative industry that routinely churns out wonder drugs. In practice, pharma companies are far more focused on boosting their share price than on developing new drugs. For example, in 2018, "the 10 biggest pharmaceutical companies spent nearly 170 percent of their net income (tapping cash reserves and borrowing) on payments to shareholders and executives through stock buybacks and dividends".

Vaccines are a classic example of a global public good. It is in the interest of every individual and government to ensure that everyone gets vaccinated as quickly as possible, but it is in the interest of an extremely powerful industry (pharma) to ensure that the existing IP paradigm and for-profit vaccine production model are preserved, even if that comes at the expense of getting everyone vaccinated as quickly as possible.

A better system for vaccine development would be to have a prize system. The government decides that a cure for X is worth $5B. A pharmaceutical company believes they can develop the cure for X for $4B. The govt buys the rights to the cure for the prize price and open-sources it, allowing companies to make generic version of it and sell them at cost.

I would go further and return to a fully public vaccine development and distribution model, similar to what we had in the mid 20th century.

From another article by the Gates-article author:

"A public pharma sector would operate according to the norms and laws that have governed science for most of history. Because the system would not be based on the maximum pricing of drugs artificially protected from competition, there would be no incentive to erect barriers to science. Instead of licensing breakthroughs to private companies, U.S. labs could make contributions to global patent pools, not just when pandemics threaten, but as a matter of permanent policy. While private industry might not survive government competition in, say, the insulin market, companies could focus on lifestyle drugs, or perform niche roles in the public production of essential medicines. "

I think either system would be a massive improvement from the status quo, where companies under-invest in unprofitable drugs like vaccines and hoard useful research.

Gates, whose fortune is the result of the intellectual property system, is standing in the way of changes to that system which would increase the availability and decrease the cost of vaccines. I think the harms of this opposition could easily outweigh the positive contributions Gates and his foundation have made to fighting COVID.

The enormous global inequality in vaccine access is the most important story in the world, in my view, but I've seen very little EA writing on the topic. What do you think?

Both AstraZeneca and J&J have agreed that they will sell the vaccines at cost during the pandemic; this is mentioned in one of the articles you linked.

Unfortunately, this agreement has had major downsides. By preventing AstraZeneca from making a profit, it has undermined their ability to invest in capacity, and is one of the causes of the numerous production setbacks we have seen. I think it would have been much better if AstraZeneca was allowed to charge higher prices to incentivise them to produce more! If there is a shortage, that suggests that prices are too low, not too high.

AstraZeneca signed a voluntary licensing agreement with various Indian manufacturers to allow them to produce its vaccine. This fact was pointed out to you when you wrote about this subject on facebook.

Given you highlight Moderna, why did you not mention that they have in fact agreed not to enforce their vaccine IP rights during the pandemic?

As it happens, I doubt this will be that important a move. Manufacturing mRNA vaccines is a very advanced business that requires a lot of expertise; these are not small molecule drugs! Even with the IP waiver I suspect most others would struggle to do what Moderna and Pfizer have achieved. There just is not a huge amount of currently idle capacity in this supply chain. For more detail on the manufacturing details, I recommend reading this article.

Developing new drugs and 'boosting the share price' are not in opposition. If a company develops a promising new drug, the expectation of future profits will cause the share price to increase. This is why biotech companies can see their share prices go up even if they are not doing any cash return at all.

I also think you have misunderstood how accounting works. Net Income is after R&D expense. The more a company spends on R&D, the lower Net Income will be. The fact that Net Income is low compared to cash return doesn't mean that the company isn't doing R&D.

As an example, take a look at Pfizer. In 2020 they spent about $9.4bn on R&D vs Net Income of around $9.6bn. This exceeded their dividends and buybacks, which were around $8.4bn. And we should probably also included M&A, which is basically indirect R&D. This is lumpy but large - e.g. over $10bn for 2019 for example.

I actually think that it is a major problem how low the prices for the vaccines have been. These drug companies have provided us with a way out of the pandemic that many people thought was impossible - and very few expected as quickly as this. For this they should have been richly rewarded - we want to incentivise companies to work on the world's biggest problems for the future! Unfortunately, if you look at the share prices of Pfizer or AstraZeneca and compare them to the broader market, you can see this was not the case. Given the amount these companies have been attacked by politicians, I think it is plausible that AstraZeneca leadership might regard this entire endeavour as a mistake.

Also this report that big pharma R&D costs are vastly overblown; it is what I had suspected, now upheld by research.