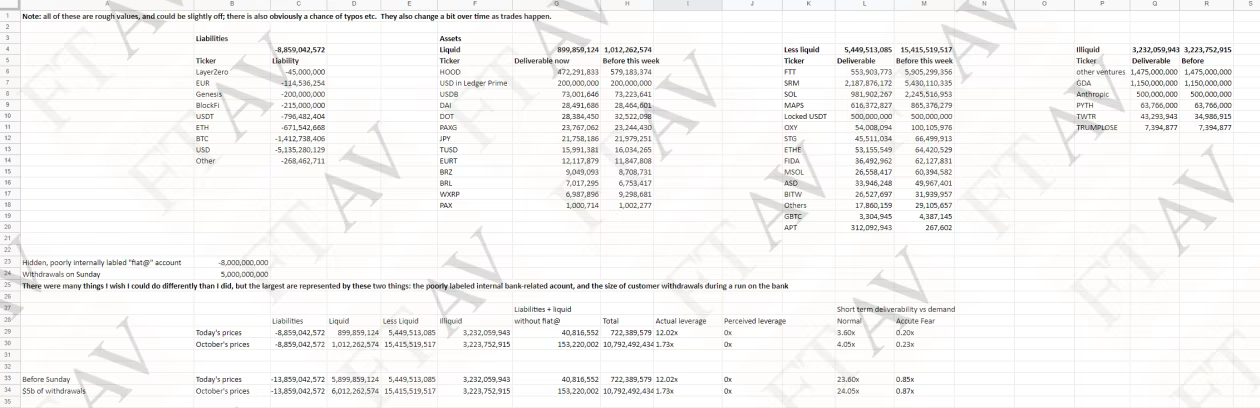

Matt Levine explains that FTX's balance sheet (which has been leaked) is a nightmare. Sample quote:

And then the basic question is, how bad is the mismatch [between liabilities and assets on the balance sheet]. Like, $16 billion of dollar liabilities and $16 billion of liquid dollar-denominated assets? Sure, great. $16 billion of dollar liabilities and $16 billion worth of Bitcoin assets? Not ideal, incredibly risky, but in some broad sense understandable. $16 billion of dollar liabilities and assets consisting entirely of some magic beans that you bought in the market for $16 billion? Very bad. $16 billion of dollar liabilities and assets consisting mostly of some magic beans that you invented yourself and acquired for zero dollars? WHAT? Never mind the valuation of the beans; where did the money go? What happened to the $16 billion? Spending $5 billion of customer money on Serum would have been horrible, but FTX didn’t do that, and couldn’t have, because there wasn’t $5 billion of Serum available to buy. FTX shot its customer money into some still-unexplained reaches of the astral plane and was like “well we do have $5 billion of this Serum token we made up, that’s something?” No it isn’t!

Mirror to avoid paywall: https://archive.ph/hZszH (Loading the article in a private browsing window would probably work too.)

Sure, sure. My question was in response to the quote in the original article, not the format. Specifically, “FTX shot its customer money into some still-unexplained reaches of the astral plane.”