Update: This project has been funded by an EA Funds grant. I am actively working on it-if you are interested in supporting this, send me a message.

I'm considering setting up a charity. Its goals are:

- To help effective altruists in financial need by giving back part of their donations

- To promote large donations to EA-related causes by providing donors with a safety net, minimizing risk

- To foster a healthy EA community

To achieve these goals, the charity will maintain an emergency fund. If effective altruists encounter financial hardship, they can send an application for hardship payment. This process will be similar to filing an insurance claim, but less strict. If the application is accepted, we'll pay out the lowest of three figures:

- The payout suggested by the hardship examiner

- 50% of the donor's lifetime donations to cost-effective charities

- 75,000 USD, or the equivalent amount in another currency

To prevent fraud, donors will have to get their charity to state to us that they'll never return any funds to the donor, and we'll need to see their donation receipts. We won't have to worry about fraud nearly as much as insurers, because our hardship payments max out at half of what recipients donated over their lifetime. Because of that, it is incredibly difficult to cook up a net-positive scheme involving our fund.

As far as I know, this type of charity does not exist yet, and there are a lot of things that still need to be figured out. More extensive discussion can be found here (me) and here (Alicorn). Note that both linked essays discuss a fund that only offers support to contributors (excluding direct donors). I no longer think that is desirable, and it will be very difficult to convince governments to grant such a construction tax-exempt status.

This post can be considered a response to that very comment! The main change is described here:

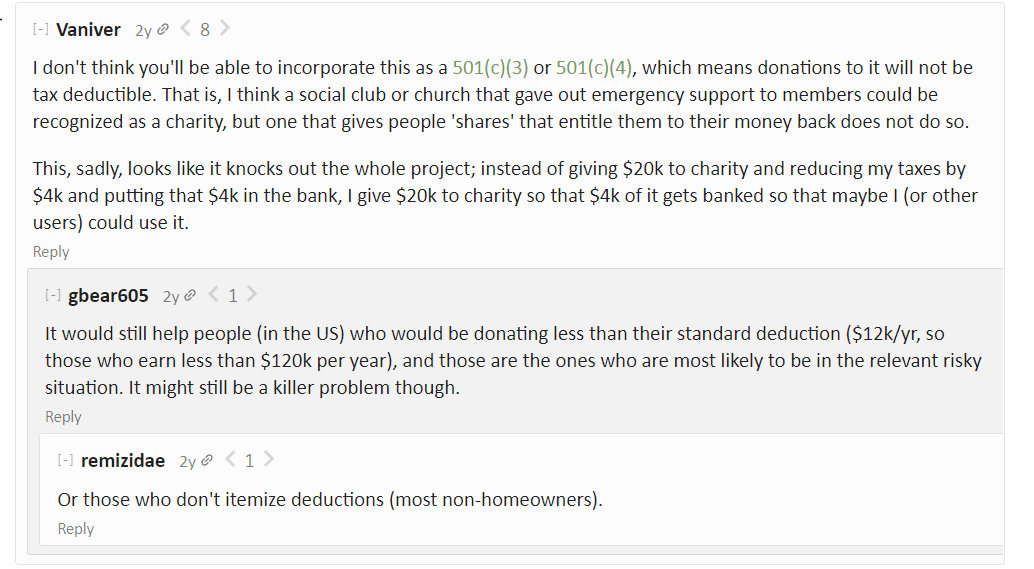

By expanding the scope to all donors to EA-related causes, contributors to the fund no longer gain an entitlement. This means that the fund will almost certainly be recognized as a charity, and donations will be tax-exempt.

As for the long silence, I only recently had the time to contemplate the change I made.