We can use Nvidia's stock price to estimate plausible market expectations for the size of the AI chip market, and we can use that to back-out expectations about AI software revenues and value creation.

Doing this helps to understand how much AI growth is expected by society, and how EA expectations compare. It's similar to an earlier post that uses interest rates in a similar way, except I'd argue using the prices of AI companies is more useful right now, since it's more targeted at the figures we most care about.

The exercise requires making some assumptions which I think are plausible (but not guaranteed to hold).

The full analysis is here, but here are some key points:

- Nvidia’s current market cap implies the future AI chip market reaches over ~$180bn/year (at current margins), then grows at average rates after that (so around $200bn by 2027). If margins or market share decline, revenues need to be even higher.

- For a data centre to actually use these chips in servers costs another ~80% for other hardware and electricity, then the AI software company that rents the chips will typically have at least another 40% in labour costs.

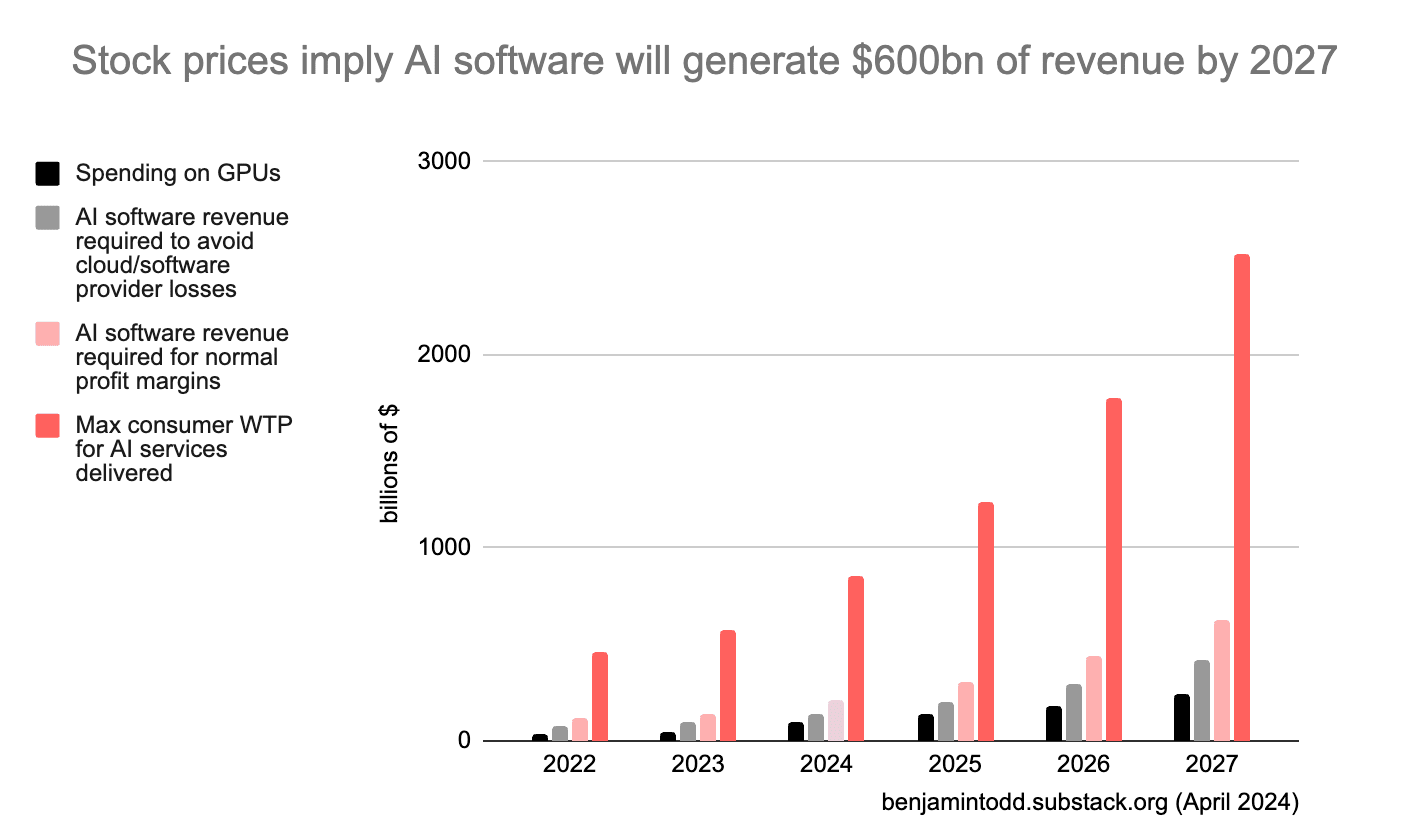

- This means with $200bn/year spent on AI chips, AI software revenues need reach $500bn/year for these groups to avoid losses, or $800bn/year to make normal profit margins. That would likely require consumers to be willing to pay up to several trillion for these services.

- The typical lifetime of a GPU implies that revenues would need to reach these levels before 2028. If you made a simple model with 35% annual growth in GPU spending, you can estimate year-by-year revenues, as shown in the chart below.

- This isn’t just about Nvidia – other estimates (e.g. the price of Microsoft) seem consistent with these figures.

- These revenues seem high in that they require a big scale up from today; but low if you think AI could start to automate a large fraction of jobs before 2030.

- If market expectations are correct, then by 2027 the amount of money generated by AI will make it easy to fund $10bn+ training runs.

Hi Wayne,

Those are good comments!

On the timing of the profits, my first estimate is for how far profits will need to eventually rise.

To estimate the year-by-year figures, I just assume revenues grow at the 5yr average rate of ~35% and check that's roughly in line with analyst expectations. That's a further extrapolation, but I found it helpful to get a sense of a specific plausible scenario.

(I also think that if Nvidia revenue looked to be under <20% p.a. the next few quarters, the stock would sell off, though that's just a judgement call.)

On the discount rate, my initial estimate is for the increase in earnings for Nvidia relative to other companies (which allows us to roughly factor out the average market discount rate) and assuming that Nvidia is roughly as risky as other companies.

In the appendix I discuss how if Nvidia is riskier than other companies it could change the estimate. Using Nvidia's beta as an estimate of the riskiness doesn't seem to result in a big change to the bottom line.

I agree analyst expectations are a worse guide than market prices, which is why I tried to focus on market prices wherever possible.

The GPU lifespan figures come in when going from GPU spending to software revenues. (They're not used for Nvidia's valuation.)

If $100bn is spent on GPUs this year, then you can amortise that cost over the GPU's lifespan.

A 4 year lifespan would mean data centre companies need to earn at least $25bn of revenues per year for the next 4 years to cover those capital costs. (And then more to pay for the other hardware and electricity they need, as well as profit.)

On consumer value, I was unsure whether to just focus on revenues or make this extra leap. The reason I was interested in it is I wanted to get a more intuitive sense of the scale of the economic value AI software would need to create, in terms that are closer to GDP, or % of work tasks automated, or consumer surplus.

Consumer value isn't a standard term, but if you subtract the cost of the AI software from it, you get consumer surplus (max WTP - price). Arguably the consumer surplus increase will be equal to the GDP increase. However, I got different advice on how to calculate the GDP increase, so I left it at consumer value.

I agree looking at more historical case studies of new technologies being introduced would be interesting. Thanks for the links!