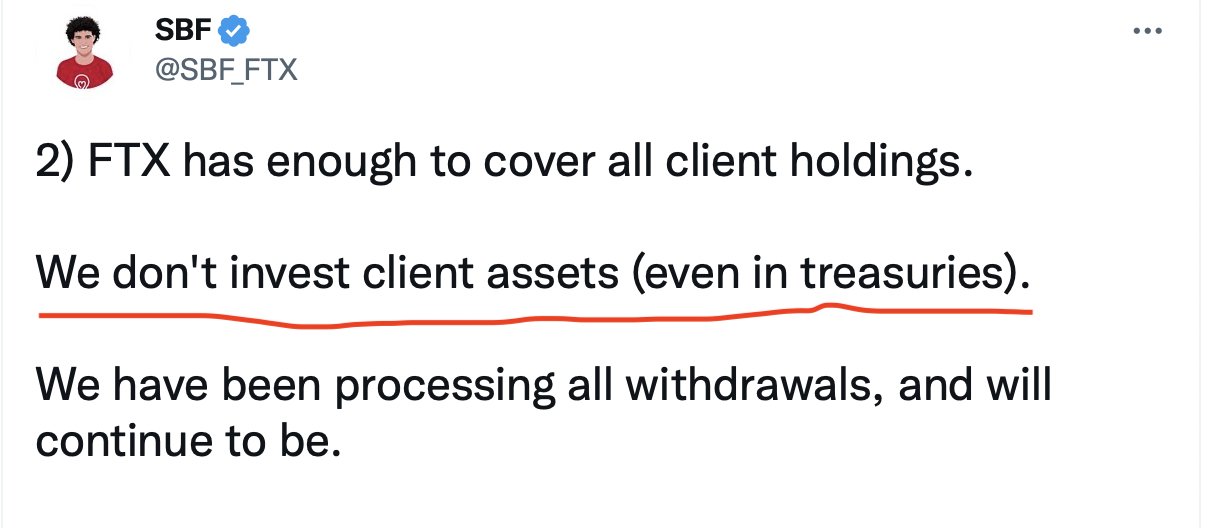

See: https://twitter.com/SBF_FTX/status/1590012124864348160

This is probably related to liquidity issues / solvency issues.

Sketch of timeline:

- A CoinDesk article comes out claiming that much of FTX and Alameda assets are just its own tokens ("TFF" or "SOL") and there is a circular relationship in assets between the two entities.

- Aggressive/hostile, but crisp analysis here: https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent

- As a hostile action, another exchange / leader ("CZ") publicly announced it was liquidating FTT token.

- FTT falls by about 26% on Nov 7.

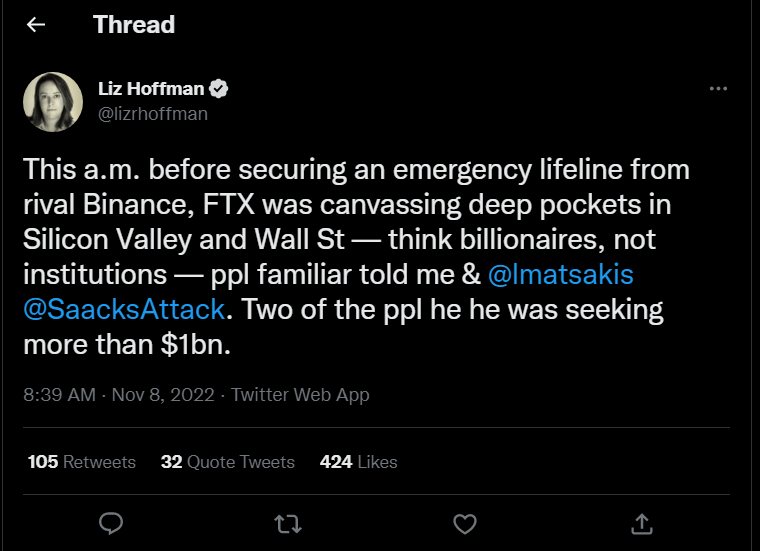

- There is probably further pressure on FTX, see HN discussion of FTX withdrawals: https://news.ycombinator.com/item?id=33518961

Few more things on FTX/Alameda (from Financial Times’ Alphaville blog)

Reuters on what may have happened (ie possible transactions connecting FTX and Alameda as well as Binance’s opaque history)

https://www.reuters.com/technology/exclusive-behind-ftxs-fall-battling-billionaires-failed-bid-save-crypto-2022-11-10/

An old story on SBF & FTX’s history & connections to EA

https://www.sequoiacap.com/article/sam-bankman-fried-spotlight/

Probably less directly relevant now (except as it impacts crypto values generally), but some info on Binance’s opaque financial arrangements

https://www.creditslips.org/creditslips/2022/11/binances-custodial-arrangements-whose-keys-whose-coins-.html