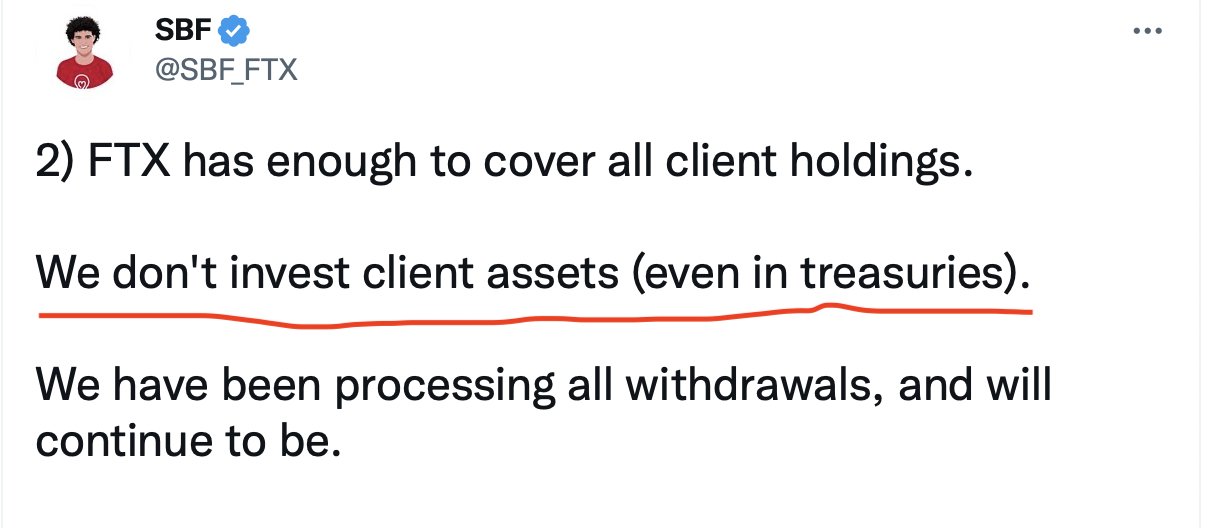

See: https://twitter.com/SBF_FTX/status/1590012124864348160

This is probably related to liquidity issues / solvency issues.

Sketch of timeline:

- A CoinDesk article comes out claiming that much of FTX and Alameda assets are just its own tokens ("TFF" or "SOL") and there is a circular relationship in assets between the two entities.

- Aggressive/hostile, but crisp analysis here: https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent

- As a hostile action, another exchange / leader ("CZ") publicly announced it was liquidating FTT token.

- FTT falls by about 26% on Nov 7.

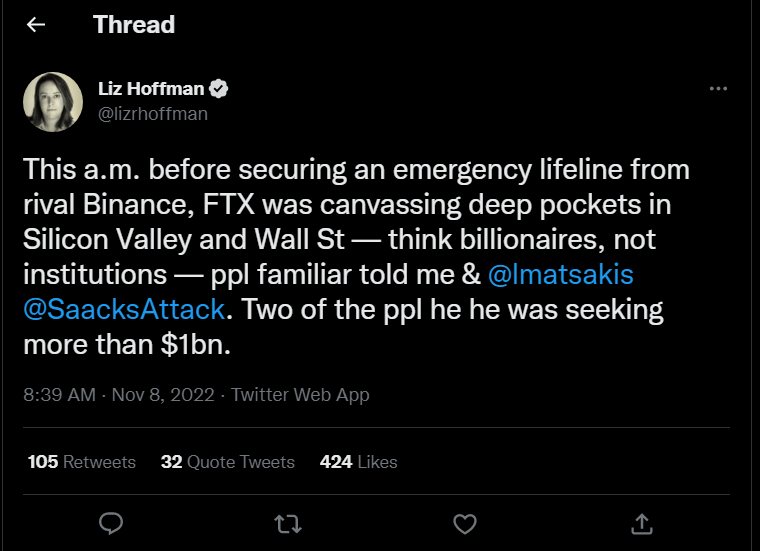

- There is probably further pressure on FTX, see HN discussion of FTX withdrawals: https://news.ycombinator.com/item?id=33518961

I think if he lied publicly about whether FTX's client assets were not invested then I think this should very much reduce a reasonable person's opinion of him. If lying straightforwardly in public does not count against your character, I don't know what else would.

That said, I don't actually know whether any lying happened here. The real situation seems to be messy, and it's plausible that all of FTX's client assets (and not like derivatives) were indeed not invested, but that the thing that took FTX out were the leveraged derivates they were selling, which required more advanced risk-balancing, though I do think that Twitter thread looks really quite suspicious right now.