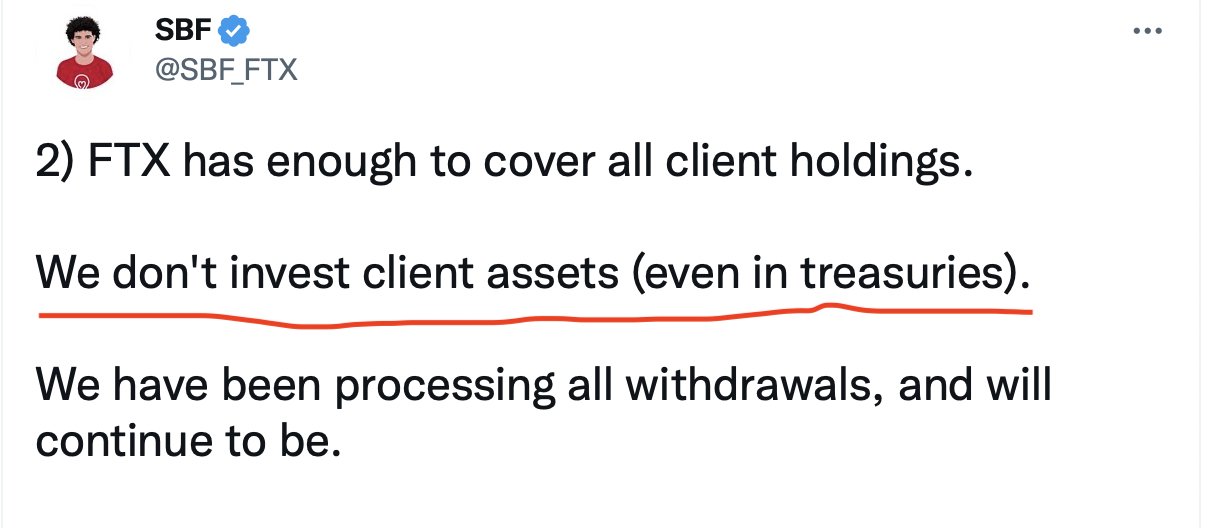

See: https://twitter.com/SBF_FTX/status/1590012124864348160

This is probably related to liquidity issues / solvency issues.

Sketch of timeline:

- A CoinDesk article comes out claiming that much of FTX and Alameda assets are just its own tokens ("TFF" or "SOL") and there is a circular relationship in assets between the two entities.

- Aggressive/hostile, but crisp analysis here: https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent

- As a hostile action, another exchange / leader ("CZ") publicly announced it was liquidating FTT token.

- FTT falls by about 26% on Nov 7.

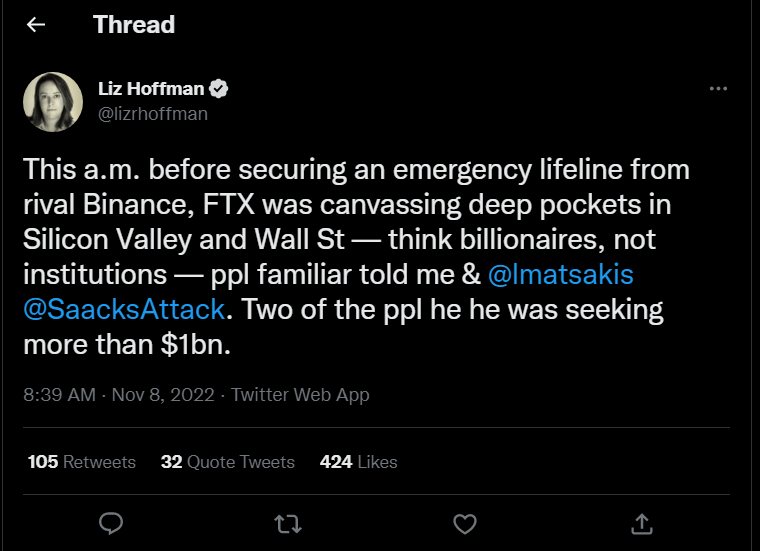

- There is probably further pressure on FTX, see HN discussion of FTX withdrawals: https://news.ycombinator.com/item?id=33518961

I'm confused about this. This seems to explain why customers with invested assets can't withdraw immediately. But if a customer has only cash in their account, why can't they withdraw it if it's not being invested? If customer A's cash is being used to secure margin loans for customer B, then how is it true that customer A's cash is "not invested"?