See: https://twitter.com/SBF_FTX/status/1590012124864348160

This is probably related to liquidity issues / solvency issues.

Sketch of timeline:

- A CoinDesk article comes out claiming that much of FTX and Alameda assets are just its own tokens ("TFF" or "SOL") and there is a circular relationship in assets between the two entities.

- Aggressive/hostile, but crisp analysis here: https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent

- As a hostile action, another exchange / leader ("CZ") publicly announced it was liquidating FTT token.

- FTT falls by about 26% on Nov 7.

- There is probably further pressure on FTX, see HN discussion of FTX withdrawals: https://news.ycombinator.com/item?id=33518961

This comment is speculative/editorial.

Coordination / Bailout

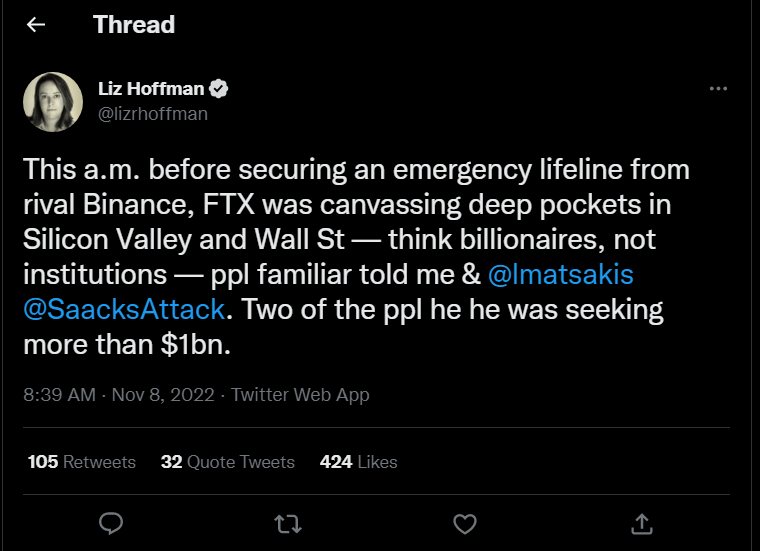

Some sort of coordination or saving of FTX seems desirable. Relevant to this, tweets by Liz Hoffman claims FTX reached out this morning privately for aid. The ask may have started at $1B, but in a few hours the need rose to $5B.

https://twitter.com/lizrhoffman/status/1590021299295768578

If this is true, it seems plausible that the smaller amount could have been secured, but the increasingly larger amounts made it difficult. This seems relevant to ideas about coordination or bailout.

Cause of collapse seems relevant / Bank run seems problematic

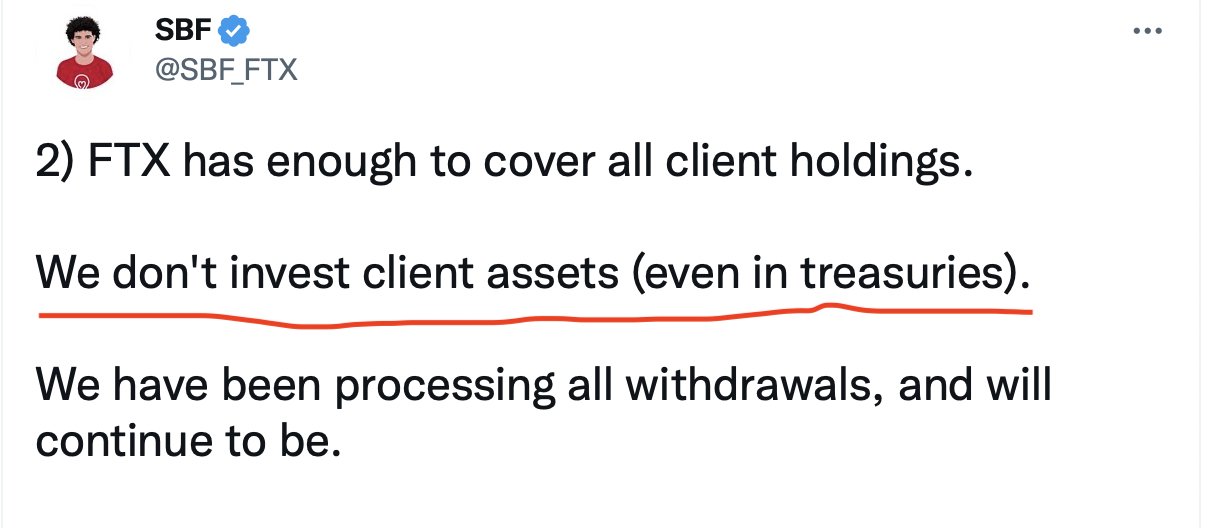

Notice that it's unclear how collapse of its tokens and especially a run of withdrawals would cause solvency or liquidity issues for FTX.

For customer deposits, FTX should be holding assets as cash/tokens, not lending them out or leveraging them. This is what SBF has represented.

It seems possible that FTX had leveraged non-customer assets as part of its business strategy, and the collapse took them by surprise. It could be the suspension of customer withdrawals was simply due to the volume of withdrawals (the amount was rumored to be up to $6B this Tuesday).

It seems good for to EA that this is explained. It seems that SBF, EA competency, and the long term future seems all associated by now.

Your comment is valid. This reply is getting into sort of low quality/twitter/reddit style speculation and I might stop writing after this:

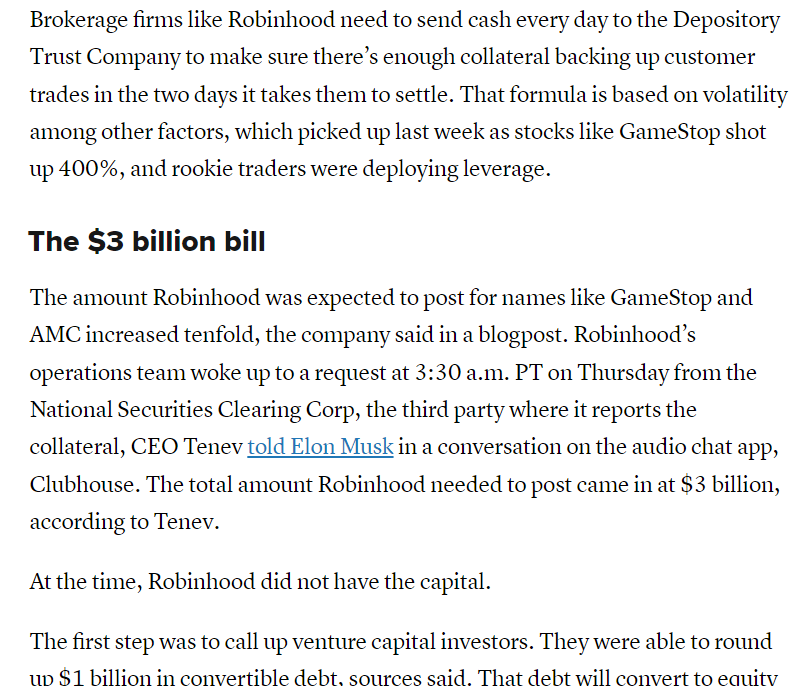

Some factors that seem different:

- That was Jan 2021, when I think the economy was still in one of the greatest bull runs in human history, money is tighter now for various reasons

- At RH, the underlying problem was pretty well defined, and easy to communicate/verify

- RH probably had more integration/acceptance in conventional finance. Crypto can be openly hostile, SBF was probably relying on less conventional backstops from

... (read more)